Luxembourg is the leading financial centre for the distribution of cross-border life insurance products in the Eurozone. This is reflected by the presence of over 40 world-leading life insurance companies in the country, which have built strong expertise in offering tailor-made insurance products, notably unit-linked life insurance plans for globally mobile clients.

The reasons for this success are multiple and include:

- The cross-border expertise of the insurance ecosystem honed over the last three decades since the very start of the European internal insurance market,

- Strong protection for subscribers to Luxembourg life insurance policies,

- Conformity of life insurance products to the contract and tax legislation of the country of residence of the subscriber,

- A sound regulatory and supervisory framework, in line with European directives

- An insurance dedicated local supervisory authority, the CAA.

One of the key strengths of the Luxembourg financial ecosystem is the ability to adapt, to adjust and to tailor to the high end of the market. International clients also seek out Luxembourg life insurance for its high level of protection.

The advantages of Luxembourg’s multicultural and multilingual ecosystem also apply to life insurance sales and distribution activities. Most foreign life insurers have set up Luxembourg-based subsidiaries, while others decided to provide services across Europe from Luxembourg branches using EU freedom of establishment rules. In both cases, foreign insurers harness their Luxembourg platform to centralise their EU activities and function as a single point of contact for all their clients across continental Europe.

Instead of having to establish a team in each jurisdiction, a firm can simply draw on the expertise of its Luxembourg-based multilingual staff to adapt its products to the requirements of each separate EU market. Given the complexity of international insurers’ legal structures, these business models help to lower costs through economies of scale, improve productivity, by reducing duplicated efforts, and ensure decreased regulatory compliance costs, while providing a greater degree of operational flexibility.

In the past when interest rates were high, a lot of our business was based on guaranteed rate solutions. When rates fell, however, this product became less interesting, but there are still some clients who request such investments, not because they are rewarding, but because of the certainty they provide.

Life insurance contracts are a key component of wealth management and are a highly sophisticated and versatile long-term wealth management tool. Luxembourg life insurance products are key to the success of European wealth management, thanks to:

- Their international portability;

- Flexibility in investment and contract design;

- Fhe opportunity to combine Luxembourg life insurance contracts with a wide array of investment fund vehicles.

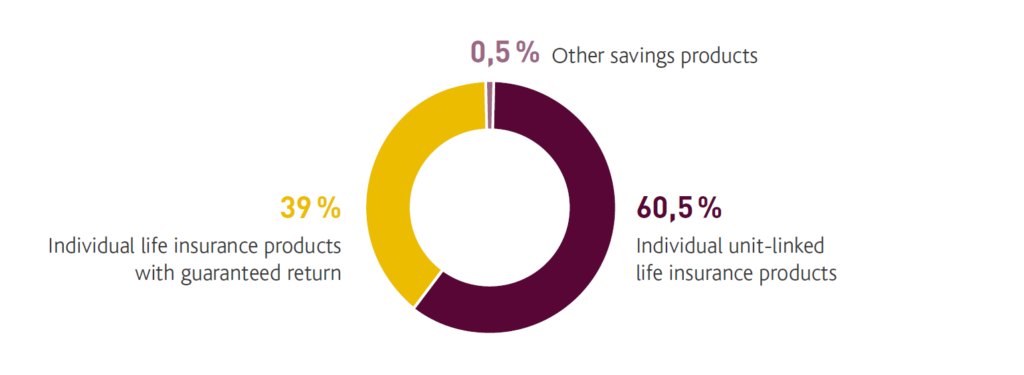

The national and international life insurance sector in Luxembourg has shown great resiliency amid the Covid-19 crisis. Revenues from guaranteed-return insurance products decreased as a consequence of the current low interest environment which led insurers to no longer promote this type of products. Nonetheless, premiums attached to unit-linked life insurance products remained remarkably stable in the first quarter of 2020 and only reported a 5.24% decrease, which is explained by the relatively low amount of redemptions.

In the past when interest rates were high, a lot of our business was based on guaranteed rate solutions. When rates fell, however, this product became less interesting, but there are still some clients who request such investments, not because they are rewarding, but because of the certainty they provide.

INSURANCE:

A LEADING FINANCIAL CENTRE IN EUROPE

-

A LEADING FINANCIAL CENTRE IN EUROPE En savoir plus

-

INSURANCE IN LUXEMBOURG En savoir plus

-

LUXEMBOURG LIFE INSURANCE En savoir plus

-

LUXEMBOURG LIFE INSURANCE En savoir plus

-

LUXEMBOURG NON-LIFE INSURANCE En savoir plus

-

LUXEMBOURG REINSURANCE En savoir plus

-

FUTURE CHALLENGES FOR THE INSURANCE INDUSTRY En savoir plus